- Details

- Category: News

Senator Don Harmon (D-Oak Park) issued the following statement today regarding his vote in support of House Bill 40, legislation that would ensure women in Illinois continue to have access to important reproductive health care:

Senator Don Harmon (D-Oak Park) issued the following statement today regarding his vote in support of House Bill 40, legislation that would ensure women in Illinois continue to have access to important reproductive health care:

“It’s 2017. Women make up just over half of the population in Illinois, and 70 percent of them are in the labor force.

“But today, rather than paving the way to lift women out of poverty, close the gender wage gap, make child care more affordable or enable all parents to take time off to care for sick kids, the Illinois Senate had to debate whether it’s appropriate to reassure the women who live and work in our communities that they are legally entitled to access the medical care of their choosing without government interference.

“How 1960s of us.

“Voting for House Bill 40 was the right thing to do, and I urge Gov. Rauner to keep his campaign promise to do the right thing on behalf of the women of Illinois and sign it into law as soon as it lands on his desk.”

House Bill 40 passed in the Illinois Senate 33 to 22 on Wednesday. It previously was approved in the House and will be sent to the governor for consideration.

- Details

- Category: News

Oak Park siblings Audrey and Sam Benzkofer joined state Senator Don Harmon (D-Oak Park) at the Capitol in Springfield as his pages for the day on Wednesday, May 3.

Oak Park siblings Audrey and Sam Benzkofer joined state Senator Don Harmon (D-Oak Park) at the Capitol in Springfield as his pages for the day on Wednesday, May 3.

Audrey Benzkofer, 9, is a fourth-grader at Beye Elementary School. Sam Benzkofer, 14, is an eighth-grader at Percy Julian Middle School.

Audrey and Sam toured the Capitol, attended Senate committee hearings with Harmon and accompanied him on the Senate floor, where they met lawmakers and listened to debate about legislation.

Their parents are Stephan and Marjorie Benzkofer of Oak Park.

- Details

- Category: News

Senator Don Harmon (D-Oak Park) issued the following statement regarding the passage of automatic voter registration legislation in the Illinois Senate on Friday, May 5:

“Automatic voter registration is a concept whose time has come. It will save the state money, strengthen the integrity of the electoral system by cleaning up the voter rolls, and make life easier for the residents of Illinois. I urge the House to pass this legislation and Gov. Rauner to sign it into law.”

Senate Bill 1933 would establish an automatic voter registration system in Illinois by July 1, 2018.

Under the system, qualified voters would be automatically registered to vote when they visit the Illinois secretary of state and other state agencies for services. Voters would be able to opt out of the system if they wish. A series of checks would ensure no one is registered to vote that should not be.

Illinois currently has an opt-in voter registration system in which adults who are 18 or older must find, fill out and submit a voter registration form to an appropriate government agency. Voters frequently forget to update their voter registrations when they move, change marital status or go to college, causing confusion at the polls and inaccuracies on the state’s voter rolls.

Automatically registering voters when they do business with the state enables government to do away with redundant paperwork, streamline bureaucracy and be more cost effective for taxpayers.

- Details

- Category: News

An effort to foster trust between Illinois police agencies and immigrants who live in the state passed out of the state Senate Thursday.

An effort to foster trust between Illinois police agencies and immigrants who live in the state passed out of the state Senate Thursday.

Local police should not have to do the federal government’s job, and immigrants should not have to live in fear of local police, Senator Don Harmon (D-Oak Park) said after casting a vote for Senate Bill 31, which would create the Illinois Trust Act. Harmon is a chief co-sponsor of the legislation.

“Illinois has long been a state that welcomes people from all nations. It’s one of the things I love the most about this state,” Harmon said. “But in this time of fear and uncertainty for many immigrants who live in our communities, it is important that we take steps to foster trust between local authorities and immigrants who have done nothing wrong and have nothing to hide.”

The point of the Trust Act is simple: immigrants in Illinois should be able to pick up their children from school or go to the hospital without fear of arrest, and state and local police officers should be assured they’re not expected to enforce federal immigration laws. The act would:

- clarify that state and local police are not deputized immigration agents and therefore are not expected to expend resources enforcing or complying with federal civil immigration detainers and administrative warrants;

- prohibit state and local police from searching, arresting or detaining a person based solely on citizenship or immigration status or an administrative warrant;

- prohibit law enforcement agencies from using state resources to create discriminatory federal registries based on race, national origin, religion or other protected classes; and

- establish safe zones at schools, medical facilities and properties operated by the Illinois secretary of state, where federal immigration enforcement would not be admitted without a valid criminal warrant.

The measure also would establish deadlines for police to complete certification forms that are requested by immigrant victims of violent crimes who cooperate with police. The certifications are among the requirements for immigrant crime victims to apply for certain visas.

The act would not bar state and local police from conducting valid criminal investigations or serving criminal warrants, nor would it bar them from working with federal immigration agents to serve valid criminal warrants.

Several Illinois communities, including Oak Park, have passed “welcoming ordinances” in recent months that bar local authorities from collaborating with federal immigration officials to identify and apprehend undocumented citizens without a criminal warrant.

“Everyone should feel like they can go to the police when they need help or have something to report,” Harmon said. “Unfortunately, the president’s hateful rhetoric has had a chilling effect on immigrants’ willingness to come forward and report crimes because they’re afraid of being deported. We can’t allow that to stand.”

The Trust Act passed the Senate in a vote of 31-21 Thursday evening.

- Editorial: Demand a criminal warrant before cops can detain an immigrant (Chicago Sun-Times)

- In the news: Illinois Senate passes anti-Trump law enforcement immigration bill (Chicago Tribune)

- In the news: Illinois Senate passes 'sanctuary state' proposal (Chicago Patch)

- Slowik column: States are right to respond to federal crackdown on immigration enforcement (Daily Southtown)

- Details

- Category: News

The following column was published May 2, 2017, in the Oak Park Wednesday Journal.

When facing a problem, do something. If that doesn't work, do something else.

When facing a problem, do something. If that doesn't work, do something else.

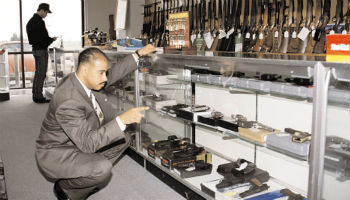

That pithy advice is credited to President Franklin Roosevelt. Last week in Springfield, we finally did something to help stop kids from dying in our streets by passing bipartisan state-level gun dealer licensing legislation.

Despite cries to the contrary from gun advocates, this proposal could bring meaningful change to the neighborhoods I represent by protecting families from the devastating scourge of senseless gun violence.

Fourteen-year-old children are shooting each other because guns end up too easily in the wrong hands. Senate Bill 1657 will give police new tools to hold corrupt or reckless gun dealers accountable and curb the flow of illegal guns to our streets. It is a meaningful step to protect our children and neighborhoods.

This measure is long overdue for Illinois.

I first introduced similar legislation in 2003 and attempted to pass it in every General Assembly since. No debate has frustrated me more. In those years, thousands of lives were lost, entire communities were destabilized, and Chicago gained widespread attention — all because of gun violence and the powerful gun lobby.

Locally, we gathered at dozens of community meetings and anti-violence rallies on the West Side. Last month, we discussed the problem at the historic Austin Town Hall, a block from the brazen daylight shooting that left one dead and five injured just days before.

At every gathering, our anger and frustration has grown, as has the desperate cry for action from grieving families and communities.

The Illinois Senate finally took a step forward on a common-sense solution. Gun dealers are the most critical link between manufacturers and the public. A recent study revealed that 40 percent of guns used in crimes in Chicago were sold by Illinois gun dealers.

Senate Bill 1657 encourages responsible business practices — including background checks, employee training and state inspection authority of dealer locations — to curb illegal transfers of guns.

Illinois would not be alone in requiring state-level licensing; 27 other states have enacted similar rules.

This is a difficult issue for many. Other corners of Illinois have different cultural mores when it comes to gun ownership and rights. Law-abiding gun owners deserve a place at the table, too. I appreciate my downstate colleagues who chose to see things from our point of view, including the lone Senate Republican brave enough to cross the aisle to get this done.

As this debate moves to the House, we will need to find more support. We will not benefit from the cooperation of the National Rifle Association, which responded to the Senate's action by instructing members to "neutralize Harmon" — an alarming but not surprising reaction.

I urge you, those who are directly affected by gun violence and who have seen the devastating effects of it, to do something to ensure this legislation is successful in the House. Call and write Illinois' state representatives to voice your support. Get involved with an anti-gun violence advocacy group.

We owe it to our children and to those we've lost to gun violence to do something.

— State Senator Don Harmon represents the 39th District, which includes Oak Park, where he is a resident.