- Details

- Category: News

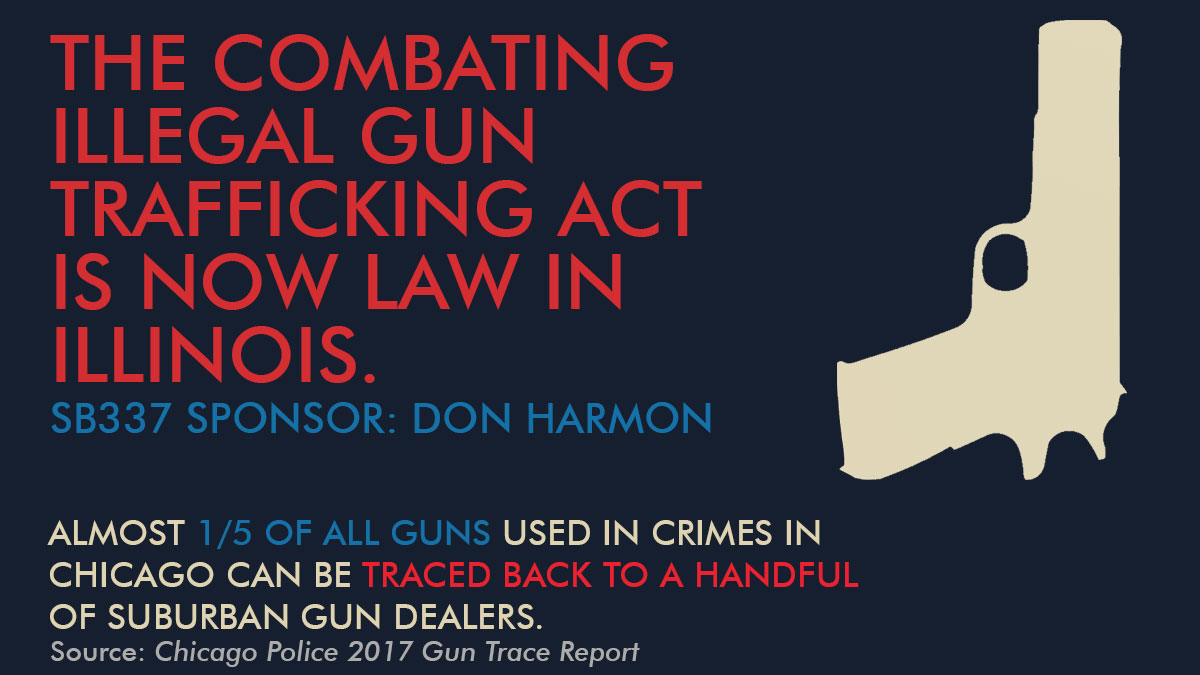

CHICAGO – Sixteen years after State Senator Don Harmon first introduced similar legislation, Gov. JB Pritzker today signed his measure requiring gun dealers to be certified by the state.

“When I first introduced a version of this bill in 2003, I thought we would be having this celebration a little sooner,” Harmon said. “This bill will help, but there’s more work to be done. I ask all of our dedicated supporters to remain in this fight."

The Combating Illegal Gun Trafficking Act contains provisions to better record and track private gun sales. It treats all firearm licensees the same, regardless of their size. It requires the Illinois State Police, rather than the state agency that regulates professions and occupations, to certify gun dealers.

Additional provisions in the bipartisan proposal include:

• requiring gun dealers to safely store firearms at all times,

• requiring gun dealers to make copies of FOID cards or IDs and attach them to documentation detailing each gun sale,

• requiring employees to undergo annual training about the law and responsible business practices, and

• requiring gun dealers to open their place of business for inspection by state and local police.

Harmon’s district includes portions of the West Side of Chicago, an area that has been plagued with gun violence for years. As of Dec. 23, the Chicago Police Department reported 555 homicides in Chicago in 2018.

“Gun violence is a complex problem, and no one law will solve it,” Harmon said. “But we know that other states that have enacted similar laws to this one have seen a reduction in guns used in crimes. I am grateful to Gov. Pritzker for signing this legislation into law.”

- Details

- Category: News

SPRINGFIELD – State Senator Don Harmon (D-Oak Park) joined his colleagues on Wednesday to begin the 101st General Assembly by being sworn in to his sixth term as state senator for the 39th District.

“A new General Assembly offers us the opportunity to take a fresh approach to some of the most pressing issues facing our state, including gun violence, pension reform, environmental protection and passing a balanced budget,” Harmon said. “I am also proud to be sworn in to a Democratic Caucus that includes a historic number of women, with our caucus now 45 percent female. I hope we continue to stand for progress and equality in the years to come.”

Harmon will assume the title of Assistant Majority Leader and continue serving in President John Cullerton’s leadership team.

Senator Harmon’s website, which includes a link to contact him, is: www.donharmon.org.

Senator Harmon can also be reached at the following office locations:

Springfield Office:

329 Capitol Building

Springfield, IL 62706

(p) 217-782-8176

Oak Park Office:

6941-B W. North Ave.

Oak Park, IL 60302

(p) 708-848-2002

- Details

- Category: News

SPRINGFIELD – State Senator Don Harmon (D-Oak Park) issued the following statement after a gunman shot and killed three people at Mercy Hospital in Chicago:

“I offer my sincerest condolences to the families of those killed, even though no amount of sympathy can bring their loved ones back.

“I especially offer my deepest gratitude to Officer Samuel Jimenez and the other Chicago Police Department officers who heroically responded to the scene and undoubtedly saved lives.

“While it is right to offer kind words and prayers following such a tragedy, these words begin to ring hollow when we find ourselves in a position to speak them on an almost daily basis.

“America is the only industrialized country that faces this level of gun violence. A recent report from the New York Times found one factor that sets us apart: the startling number of guns we sell and own.

“There is no easy, one-size-fits-all solution to our unique problem with gun violence. However, many politicians are so indebted to the NRA that they refuse to even start the conversation. In order to begin to stem the tide of the daily violence that plagues so many communities, we must treat gun violence as the public safety epidemic it truly is rather than accepting it as a fact of life in America.”

- Details

- Category: News

SPRINGFIELD – State Senator Don Harmon (D-Oak Park) issued the following statement after the Senate voted to override Gov. Bruce Rauner’s veto of legislation raising the age to legally buy tobacco products to 21:

SPRINGFIELD – State Senator Don Harmon (D-Oak Park) issued the following statement after the Senate voted to override Gov. Bruce Rauner’s veto of legislation raising the age to legally buy tobacco products to 21:

“We took a step today that we know, based on evidence from other states and communities in our own states, will reduce the rates of smoking among high school students.

“The dangers of cigarettes have been well-known for decades, and teens are even more at risk with the increasing popularity of vaping products.

“This is legislation that could prevent teenagers and young adults from ever picking up a cigarette, which could literally save their lives.”

- Details

- Category: News

SPRINGFIELD – State Senator Don Harmon (D-Oak Park) issued the following statement after the Senate voted to override Gov. Bruce Rauner’s veto of the VOICE Act:

SPRINGFIELD – State Senator Don Harmon (D-Oak Park) issued the following statement after the Senate voted to override Gov. Bruce Rauner’s veto of the VOICE Act:

“The governor’s veto was an ill-advised, knee-jerk response to the word ‘immigrant’ becoming politically charged over the last several months.

“This is a commonsense piece of legislation that simply expedites a process already in place to assist victims of terrible crimes like kidnapping, rape and human trafficking.

“I am glad we were able to put partisan politics aside today and override the governor’s veto, hopefully creating a speedier path to safety for those who come to our country fleeing unimaginable circumstances.”